Here once again is my brief weekly market report as sent out this evening.

- 2017 crop.

Trade war.

The U.S. President is escalating the war of words with China and we now seem to be heading for a full scale trade war between the U.S.A & China. Over the past few weeks the World had chosen to take an optimistic approach to the U.S./China stand-off and assumed that things would calm down. That is no longer the case and now a feeling of pessimism has gripped the World’s mkts. If a full scale trade war does blow up it will undoubtedly have a major impact on the World’s economy which in turn will have an impact on economic growth and, at least to start with, on traditional trade. The World’s economy is holding its breath and grain mkts are no exception. Stock mkts and commodity mkts (which of course includes grain) are reacting very negatively to the news and all the fundamentals have been forgotten. It would seem that we are now at the beginning of a doom and gloom scenario where rational mkt behavior will be ignored.

Currencies & mkts

Stock mkt and Commodity mkts are reacting more violently than the currency mkts to fears of an imminent U.S. / China trade war. The ECB is preferring a cautiously optimistic approach to interest rates whilst obviously being very worried about the U.S. / China situation. The Euro has lost ground and today stands at 1,155.

GM wheat in Canada

It has been off radar recently but the latest GMO scare for Canadian wheat is a stark reminder of how mkts react to news concerning the presence of GMO grain where it is not supposed to be. For those of you who did not see the story it is an incredible one. A quick summary is that someone noticed that wheat plants by the side of a farm track had not been killed off by a weed killer that had been applied. So again someone decided to investigate and checked the surviving wheat plants. They turned out to be a GMO wheat variety that had been cultivated some years again on an experimental basis but many miles away and all plants were thought to have been destroyed when the program ceased. So because Gvt was involved the results of the tests were made public. The result is that Japan and S. Korea have banned (temporarily?) imports of Canadian wheat.

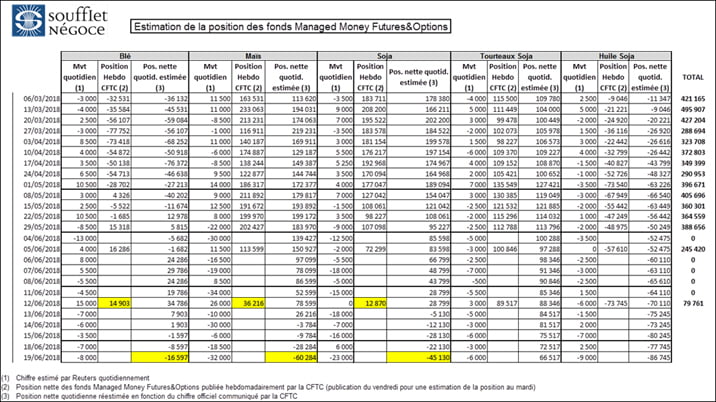

Positions

The Funds have quite dramatically turned around their open positions in the grain mkts. The last USDA report was judged as being bullish and all the fundamentals (especially the weather) are today bullish. But, as stated above, the fundamentals are now playing only a minor role in events. It is the doom and gloom scenario that is driving the mkts and because of that, and against all logic, the Funds have turned around their positions and are now short. This is interesting in a mkt where all the fundamentals are more bullish than bearish.

Chinese data

China imported 1.120.000t of barley in April. The Chinese Gvt is however not making available the breakdown of origins etc as it usually does for all grains and oilseeds. Perhaps this is related to the U.S./China trade dispute ?

Here is a recap of the import data for Jan/April :

- 2018 : 3.040.736t

- 2017 : 3.268.503t

- 2016 : 1.195.424t

- 2015 : 3.663.047t

- 2014 : 1.437.426t

This data would seem to confirm that it is going to be another big year for Chinese barley imports.

- 2018 crop.

Weather

Australia :

There has been some quite useful rainfall at last over the past week in parts of the Australian grain producing regions. NSW and Queensland were not so lucky but W. Australia, S. Australia and Victoria saw good rains. This rain was very welcome but more is needed. The problem and the danger for the farmers, is that warm dry weather is again forecasted for the next two weeks.

To make matters worse the Australian authorities have issued an El Nino warning on the 19th of June. An El Nino event normally results in a dry spring. The warning below has been issued due to increasing sea temperatures in the Pacific. The next bulletin will be published on the 3rd of July.

Europe :

Scandinavia at last got some rain but it was irregular and not enough. More rain is forecasted for the weekend. For Demark, Sweden, Finland and the Baltic States recent rains and perhaps more coming will be too late. The damage has been done and all countries are already forecasting sharply reduced yields.

Here are the recent drought alert maps for Denmark and you can easily see the effect of the recent rains which fell mainly on Jutland. Unfortunately the key producing islands of Lolland and Falster remain dangerously dry

The Danish 2rs barley acreage sown this year was made available and was a surprise. The figure which originated from the Ministry is the total number of hectares declared by Danish farmers for the E.U. payments. The trade was expecting 650/710.000ha. The official figure is 743.393ha which is a massive 38% increase on last year.

In fact all the Baltic States and Scandinavia saw a substantial increase in their barley acreages which is explained by a wet Autumn and above all farmers keen to take advantage of the very firm feed barley markets. Sadly for them the weather had other plans. The higher acreage will offset some of the damage done to yields but it will not help with the quality issues that we are expecting today. Farmers are expecting quality issues due to high proteins and poor screening.

The latest European weather maps are self- explanatory :

In Ukraine and Russia the situation remains worrying, especially in Russia.

UkrAgro has reduced their estimates for the Russian crops.

- Barley : Production – 17,40 m tons. Previous est. 18,70 m tins and last year 20,00 m tons.

Exports – 4,50 m tons. Previous est. 5,00 m tons and last year 5,50 m tons.

- Wheat : Production – 70,00 m tons. Previous est. 74,00 m tons and last year 85,80 m tons.

Exports – 33,00 m tons. Previous est. 33,00 m tons and last year 40,50 m tons.

Harvesting progress

In the Balkans and S. Europe the winter barley harvest got off to a very good and promising start. We think that in these countries the winter barley harvest progress stood at about 75% before the storms. Sadly we are now facing the prospect of rain damage on the barley that is still standing in the fields.

Here in France the winter barley harvest is just getting underway south of Paris. The weather forecast shows good dry weather with a heatwave next week so the harvest will be in full swing by the weekend.

Mkts

On Tuesday U.S. new crop mkts wheat/maize/soyabeans fell to new season lows. Soyabean mkts for example fell to their lowest level in 10 years! The trade has been simply ignoring all the fundamentals and as long as the U.S./China stand-off continues the mkts are not going to react rationally. The doom and gloom scenario has for the time being at least taken the lead in all mkts. Mkts are now highly volatile and unpredictable To have an opinion today means that you have an opinion on the outcome of the U.S. / China trade dispute. So in reality that means you might as well go to a casino. However if one takes a long cold look at events over the recent days one would be tempted to say that the mkt’s decline has been a little overdone. Mkts were in fact a little firmer this evening.

Before the trade dispute took over French malting barley mkts reached 206,00euros/t for 2rs and 177,00 for 6rw. The fall earlier this week triggered buying interest

Leave A Comment