Weekly Update – the 4th week August 2023

Headlines

World/Economy : Concerns about inflation in Europe ; Optimism on US interest rates

Crops/Weather : European malting barley harvest is over

Grain markets : Volatility on grains, Quiet in malting barley except in Germany.

Macro-economy

Sticky German and Spanish inflation lift investor bets on ECB rate rise

Investors are betting on the European Central Bank (ECB) raising interest rates after Germany and Spain reported higher-than-expected inflation. This suggests that overall eurozone price growth could surpass predictions when the bloc’s data is released. The euro rose and sovereign bonds saw a sell-off, indicating higher inflation expectations. This could lead the ECB to raise rates for the tenth consecutive time in September, despite economic concerns. Germany’s inflation reached 6.4% and Spain’s 2.4%. The eurozone’s overall inflation is expected to drop from 5.3% to 5.1%. Some ECB members worry about recession risks from excessive rate hikes.

Optimism on US interest rates

In a much-anticipated speech last Friday, the Chair of the US Federal Reserve occasionally adopted a hawkish stance, indicating the central bank’s readiness to maintain a “restrictive” policy to bring inflation down to its 2% target. At its September monetary policy meeting, the Fed is expected to consider a pause in its rate hike cycle. Moreover, the growing credibility of the assumption that rates will remain unchanged until November is evident to some observers.

Yesterday, the New York Stock Exchange closed significantly higher, prompted by US employment data that sparked speculation about the Federal Reserve (Fed) potentially halting its campaign to raise interest rates.

To be followed: At the end of the week, investors are awaiting the publication of the personal consumption expenditure price index, the Fed’s preferred measure of inflation, and data on non-farm payrolls.

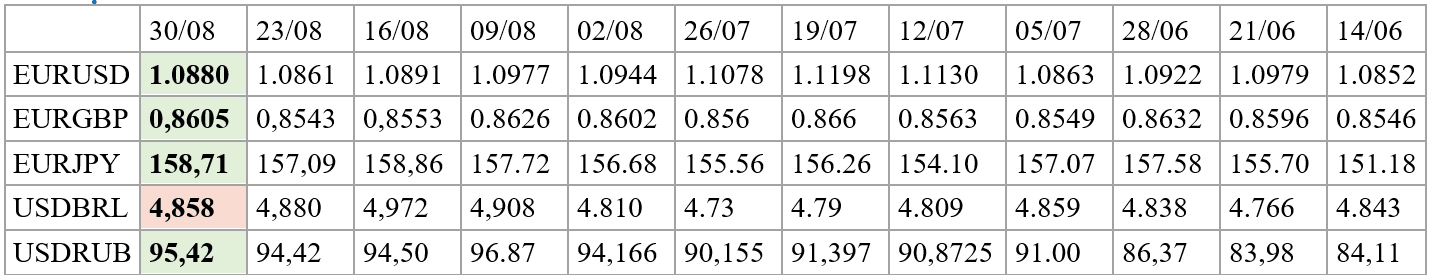

Currencies

Energy

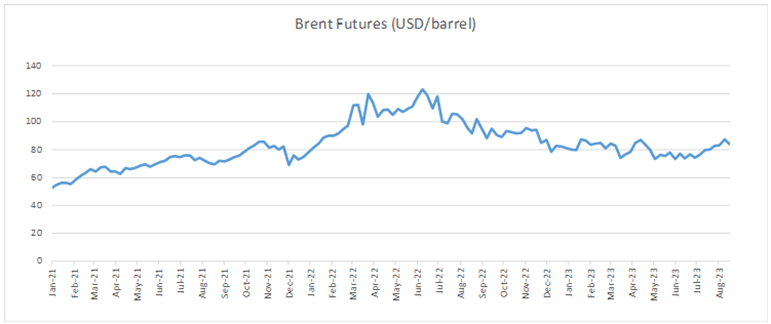

Brent crude futures surged above $85 per barrel on Wednesday, bolstered by a recent industry report indicating a massive 11.5 million barrel drop in US crude inventories last week, far surpassing the expected 2.9 million barrel decline. Official Energy Information Administration data is awaited. Concerns of supply disruptions were further fueled by a Gulf of Mexico hurricane, as the region contributes about 15% of US oil output and 5% of natural gas production.

Meanwhile, ING Bank analysts noted rising speculation regarding increased oil supply from Iran and Iraq. Negotiations between the US and Venezuela aiming to ease sanctions for fairer elections next year were also reported. Venezuela, which previously produced up to 2 million barrels daily, now produces around 0.8 million barrels.

Furthermore, signs of reduced US economic growth lifted hopes of a more lenient Federal Reserve stance, boosting oil and other risk assets.

European natural gas futures dropped to €35 per megawatt-hour, as exceptionally high gas storage levels, decreased demand, and the possibility of worker strikes being averted in Australia outweighed reduced gas supply from Norway due to maintenance. Europe’s fuel……

Leave A Comment